Numbers are like the breadcrumbs that show the way for businesses to succeed. They help businesses make good choices, understand their money, and see where it goes. All these numbers are like pieces of a puzzle, and that's where accounting system analysis comes in. It helps make sense of all those numbers.

Imagine it's like keeping an eye on your money and knowing where you're spending it. That's where Tally comes in to help. Tally is like a toolbox that makes money stuff easier, so you can focus on making your business successful.

Tally helps you with money management, creating helpful reports, and predicting what might happen in the future. These are just a few of the good things Tally can do. In this guide, we'll discover more about Tally and how it can make your business even better.

|

"Accounting system analysis isn't a mere exercise but a bridge between data and transformation. With Tally Solutions, you've armed yourself with the tools to turn those numbers into strategies that drive success." |

Understanding accounting system analysis

Let's start by peeling back the layers and interpreting the concept of accounting system analysis. Think of it as a financial health checkup for your business. Accounting system analysis is the process of closely examining your financial systems, processes, and data to ensure they're running at their best. It involves digging into everything from how you record transactions to the accuracy of your financial reports.

By conducting an accounting system analysis, you understand the strengths and weaknesses of your financial processes. Accounting system analysis is also about arming you with insights, empowering you to make smarter decisions, and ultimately fueling your business growth.

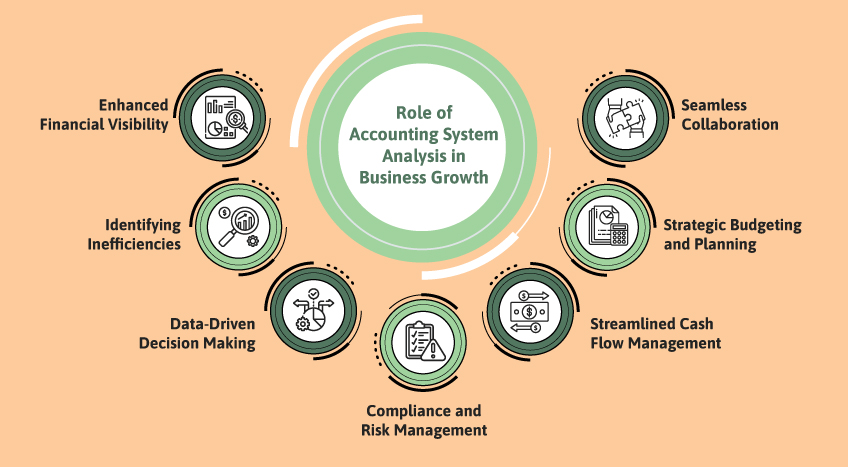

Role of accounting system analysis in business growth

Accounting system analysis plays an important role in enabling business growth. A robust accounting software such as Tally Solutions can scale along with business needs and provide valuable insights.

Enhanced financial visibility

With Tally's intuitive interface and robust reporting tools, accounting system analysis allows you to decipher your financial data like never before. 89% of businesses reported improved financial transparency after implementing Tally Solutions. This transparency equips you with real-time insights, enabling strategic decisions rooted in actual numbers.

Identifying inefficiencies

Businesses are almost always known for leaking profits due to unnoticed inefficiencies. Here's where Tally's eagle-eyed analysis steps in. Tally can pinpoint bottlenecks slowing you down by meticulously scrutinizing your financial processes. It translates to tangible results—on average, businesses using Tally Solutions identified and resolved 30% more inefficiencies than their counterparts.

Data-driven decision making

Success and growth is a data-driven endeavor. Accounting system analysis with Tally arms you with accurate historical and predictive data. Studies show that businesses harnessing Tally's data analytics make decisions 33% faster, giving them a competitive edge in rapidly evolving markets.

Compliance and risk management

The business landscape is fraught with risks, especially regulatory ones. Tally's compliance features ensure you stay on the right side of the law, reducing potential legal pitfalls. It isn't just about avoiding penalties; it's about freeing up time that you can now channel toward innovation and growth.

Streamlined cash flow management

Effective cash flow management is the lifeblood of any growing business. Tally's advanced tools empower you to track cash inflows and outflows meticulously. It allows you to optimize working capital, seize growth opportunities, and weather financial storms.

Strategic budgeting and planning

The road to growth requires a map; Tally Solutions can help chart it. Through budgeting and planning features, Tally enables you to set realistic financial goals, allocate resources efficiently, and monitor progress. This proactive approach enhances your preparedness for expansion.

Seamless collaboration

In this digital and socially connected world, collaboration is key. Tally's cloud-enabled features facilitate collaboration among teams, accountants, and stakeholders. This seamless teamwork accelerates decision-making, ensuring everyone is on the same page while navigating the growth path.

Accounting system analysis implementation in your business

You've realized the pivotal role accounting system analysis can play in driving your business growth. Now, let's delve into effectively implementing this process within your business framework. By following these steps, coupled with the power of Tally Solutions, you'll be well-equipped to pave the way for success.

Assessment and preparation

Start by assessing your current financial processes and systems. Identify pain points, bottlenecks, and areas that need improvement. Whether it's enhancing financial transparency, reducing costs, or optimizing resource allocation, define the goals you wish to achieve through accounting system analysis. Prepare your team for the changes ahead and ensure they understand the benefits.

Data collection and migration

Gather your financial data from various sources and consolidate it. Tally Solutions simplifies this process with seamless data migration tools. Import your data into Tally's platform, ensuring accuracy and completeness. This step is pivotal, as the quality of your analysis hinges on the integrity of the data you input.

Customization and configuration

Tailor Tally Solutions to fit your business's unique needs. Configure settings, categories, and preferences to align with your industry and operational requirements. Tally's user-friendly interface makes customization intuitive, enabling you to quickly set up your analysis environment.

Regular analysis routine

Commit to a regular analysis routine. Set aside time intervals for reviewing your financial data using Tally's analysis features. Identify trends, anomalies, and opportunities that can inform strategic decisions. Regularity is key to spotting patterns and making timely adjustments.

Data interpretation and action

The insights gained from your analysis are only valuable if they drive action. Interpret the data to derive actionable conclusions. For instance, consider adjusting your budget allocation if you identify a consistent overspending pattern. Tally Solutions provides visualization tools that make data interpretation intuitive.

Collaborative approach

Involve your team in the analysis process. Tally's collaborative features allow multiple stakeholders to access and contribute to the analysis. Encourage discussions and brainstorming sessions based on the insights generated. It fosters a culture of data-driven decision-making within your organization.

Continuous improvement

Accounting system analysis is an iterative process. As your business evolves, revisit your goals and analysis methods. Make necessary adjustments to align with new objectives and challenges. Tally Solutions ensures scalability, adapting to your business's changing needs.

Wrapping up

You must understand that accounting system analysis isn't a mere exercise but a bridge between data and transformation. With Tally Solutions, you've armed yourself with the tools to turn those numbers into strategies that drive success. From streamlining cash flows to making informed decisions and staying compliant, Tally's array of features empowers you to seize every growth opportunity that comes your way.

However, don't just let these insights gather digital dust. Take action! Embrace Tally's user-friendly interface and features, and let them guide your journey toward expansion. The road to growth might be dotted with challenges, but armed with Tally's analysis tools; you're better equipped to navigate them strategically.