Businesses, at any given time, can run into unexpected cash flow problems that affect their sustenance and prosperity. In these times, a business needs immediate access to more cash than it has to satisfy financial obligations. It might force even the well-run companies to liquidate assets to pay the bills. The question is how a company owner or prospective investor can understand how selling securities or accounts receivable impacts their financial position.

One technique to gauge a company's capacity to quickly turn short-term assets into cash is to look at its quick ratio. The quick ratio, sometimes known and referred to as the "acid test ratio," is a financial measure of an organization's liquidity and financial stability. It also assesses a company's capacity to turn liquid assets into cash. Today, we will explore the meaning of quick ratio, its examples, and how to calculate it.

Significance of quick ratio for businesses

A quick ratio, also called a liquidity or acid-test ratio, is a measure that assesses how well a business can use its most liquid assets to pay its short-term debt. The term acid-test ratio refers to the ability of a business to pay off its immediate creditors without liquidating any inventory.

The quick ratio considers only the company's most liquid current assets, including cash and cash equivalents, short-term investments, and accounts receivable. Since inventory cannot be converted into cash as quickly as other current assets, it is not included in the computation. Compared to the current ratio, which considers inventory, the quick ratio offers a more robust assessment of a company's liquidity. The ability of a business to settle existing liabilities right away increases with a quick ratio. A ratio of one or above is good since it indicates that the company's liquid current assets can pay its current liabilities.

How to calculate quick ratio - quick guide for business owners

The quick ratio is calculated by dividing the most liquid assets with current liabilities. These liquid assets include cash, cash equivalents, net receivables, and short-term investments. Any debt and payables with a one-year maturity date are considered current obligations.

| Quick ratio = Quick Assets / Current Liabilities |

Quick assets are the most liquid current assets that can be easily converted into cash. Most businesses limit their quick assets to only a few sorts of assets:

| Quick Assets = Cash + CE + MS + NAR |

where,

CE = Cash Equivalents

MS = Marketable Securities

NAR = Net accounts Receivable

| Current Liabilities = Accounts Payable + Accrued Liabilities + Short-Term Debt + Current Portion of Long-Term Debt |

Examples of quick ratio in business and accounting

Quick ratio examples are the best way to comprehend the term. Let's look at some examples of how to calculate the quick ratio for different companies:

-

Company A

Quick Assets: $50,000

Current Liabilities: $30,000

Quick Ratio = Quick Assets / Current Liabilities = $50,000 / $30,000 = 1.67

-

Company B

Quick Assets: $25,000

Current Liabilities: $25,000

Quick Ratio = $25,000 / $25,000 = 1.00

-

Company C

Quick Assets: $15,000

Current Liabilities: $30,000

Quick Ratio = $15,000 / $30,000 = 0.50

The higher the quick ratio, the more adept and capable the company is of paying off current liabilities with its most liquid assets. A ratio of 1 or more is ideal. Company A is better positioned to meet short-term obligations than Company C, while Company D may face liquidity issues.

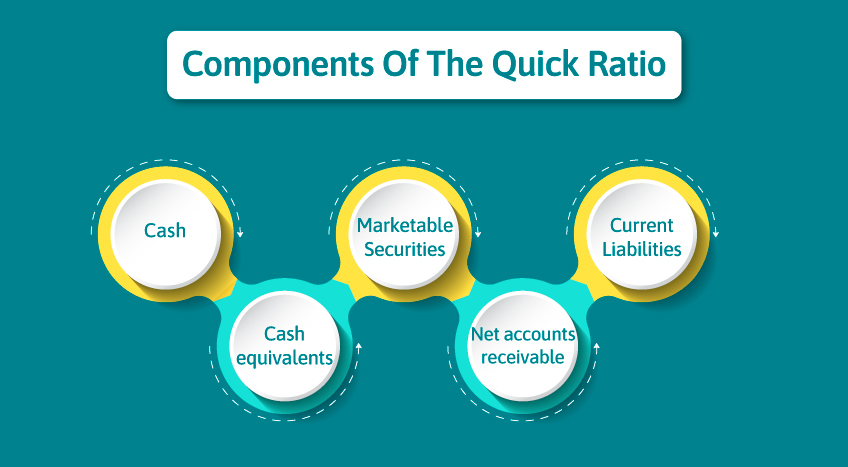

Components of the quick ratio and their business significance

Different components of quick ratio are taken into consideration for accurate calculation. These components play a significant role in the calculation of quick ratio.

Here are the 5 prime components of quick ratio you must know:

Cash

Cash is the most critical component of the quick ratio that holds no need to liquidate. A business should make an effort to match the cash balance on hand with the monthly bank statements their banking institutions send. This cash component can comprise foreign currency converted to a single denomination.

Cash equivalents

Since this account frequently holds investments with shallow risk and high liquidity, cash equivalents are frequently considered an extension of cash. Treasury bills, certificates of deposit (watch out for choices and fees to break the CD), bankers' acceptances, corporate commercial paper, and different money market instruments are typical examples of cash equivalents, though they're not the only ones.

Marketable securities

Such time-bound dependencies are typically absent from marketable securities. However, to keep the computation accurate, one should only consider the amount that will, in all likelihood, be received in 90 days or less. When assets like interest-bearing securities are liquidated or removed too soon, penalties or lowered book value may apply.

Net accounts receivable

It's still up for debate, but whether accounts receivable can provide fast, readily available cash relies on the business's credit terms to its clients. A business will have more liquidity if it requires upfront payments from clients or offers a 30-day payment window rather than a 90-day one.

However, a business might also work to extend the terms of payment agreements with suppliers and consumers, allowing it to collect payments from them more quickly and record liabilities for a more extended period. It could have a better quick ratio and pay off its current liabilities more quickly if it can convert accounts receivable into cash more quickly.

Current liabilities

Since the quick ratio doesn't try to determine when payments might be due, it removes all current liabilities from a company's balance sheet. The quick ratio assumes all current liabilities have near-term due dates. The total of several accounts, such as accounts payable, wages payable, current sections of long-term debt, and taxes payable, is frequently used to compute total current liabilities.

Final takeaways, for efficient business management

The quick ratio is a strict liquidity ratio that, by deducting inventory from current assets, assesses a company's capacity to satisfy short-term obligations with its most liquid assets. In contrast to the current ratio, it gives a more accurate liquidity picture. Examining a company's quick ratio trends over time might provide important information about its financial situation and capacity to pay future obligations.

Tally Solutions is an effective tool for computing critical financial ratios, such as the fast ratio. A cloud-based accounting and ERP solution aids companies in streamlining their financial processes and gaining insightful data. Its credit and cashflow management solution brings efficiency to cash and credit. TallyPrime's instant cash flow forecast report assists you in arranging your investment or expenditure while keeping the predicted inflow in mind.